Features

Covering over 30 countries

VATify.eu verifies data for companies from over 30 EU and non-EU countries, using VAT Information Exchange System (VIES) and country's local services (services provided by specific country's tax, customs and other financial and fiscal authorities).

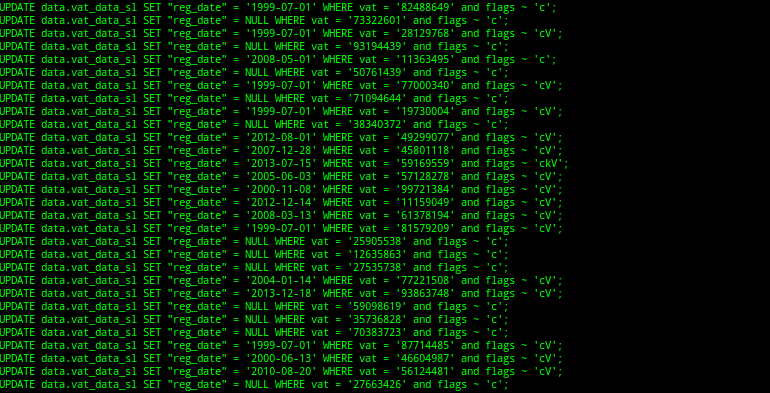

Automated

VATify.eu is completely automated: it sources the data from different websites and registries, checks for changes, updates the database and delivers notifications.

Discrete and effective alerts

To avoid spaming, reduce clutter and achieve greater awareness, VATify.eu's notifications are sent only when the system detects a change with a particular VAT ID you are tracking. To keep you up to date with your VAT IDs, a status report with all available data will be sent to you once per week. You can request it at any time here.

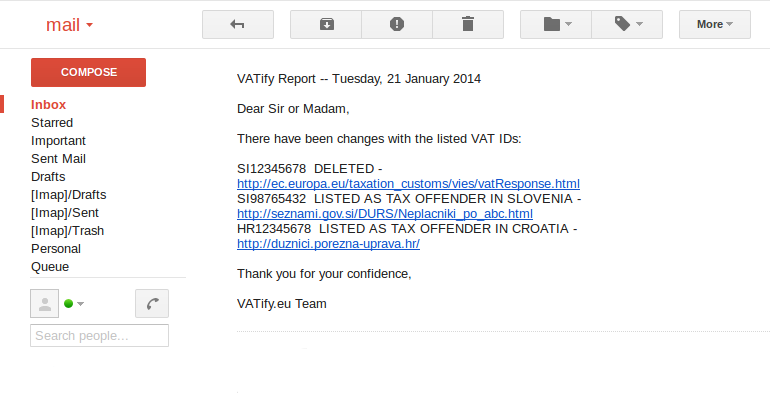

Informative and easy to verify

Every VATify.eu notification includes a name, VAT ID and links to the data source for fast and easy revisions. By clicking the link and copying the VAT ID, you can check the reason why that particular VAT ID was listed.

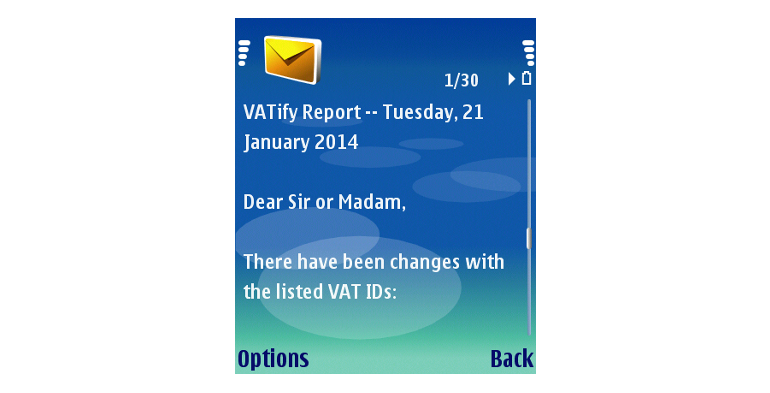

SMS and Fax notifications

If you need faster notifications and e-mail is not the fastest for you VATify.eu can send notifications by SMS or even by Fax. A Fax can be considered an outdated technology, but it does get everyone's attention when it starts making noise.

Constant improvements

New features are added whenever we find a new source of publicly available data that can be processed automatically. If you have any information or good ideas, please contact us.